These budgeting tips will help you set up your budget categories, how to do a spending analysis, and get on your way to your personal finance goals, fast.

I ‘m going to warn you. This might be a shocking experience. The first step to making a budget that works is to know what your spending habits are right now. Because I know you don’t want to spend hours mulling over your bank statements, today I’m going to show you how to analyze your spending, fast.

When there never seems to be quite enough at the end of the month, but you’re not quite sure where it’s all going, and quite frankly, you’re a little afraid to find out? Ya, I’ve been there too. I tried so hard to keep a budget for years before I finally learned a few simple changes that made it so much easier! And that’s when we started making big progress on our journey to debt free!

The biggest problem with our budget wasn’t that there wasn’t enough money, not really. It was that we didn’t even know where our money was going!

That fear of the unknown led to a lot of stress surrounding our finances.

Here’s the great news! As soon as we got a clear picture of our finances and started working toward our plan for financial freedom, all that underlying anxiety disappeared. Even before we ever pinched an extra penny or made an extra loan payment, we were feeling more free already! I hope the same will be true for you too!

So here’s how we’re going to do it.

How to Analyze Your Spending, FAST!

When I first started out budgeting, I gathered all of our bank statements and receipts from the previous month, and laboriously entered them into a spreadsheet. Then I tried to make sense of what we were spending. It took hours and hours of my time and concentration away from my family and the things I would much rather be doing.

Then I found a huge shortcut. It took a tiny fraction of the time.

Here’s the trick. It’s so simple. I started using Mint.com to manage my budget. It’s a completely free program that allows you to easily track ALL of your financial accounts all in one place. (I’m not an affiliate and they’re not a sponsor, this is what I really use because it works.)

There are a few other online budgeting tools out there, but none that are honest-to-goodness completely free. That’s what made Mint most appealing to me when we were starting out on our journey to paying off our debt.

When I signed up and started adding my accounts, it imported the previous months’ of transactions. It even started categorizing that spending automatically into different budget categories. That means 80% of my budget analysis was done for me in minutes, without the hours of studying bank statements!

I was able to add and track every different account including savings, checking, credit cards, all our student loans, and even Paypal!

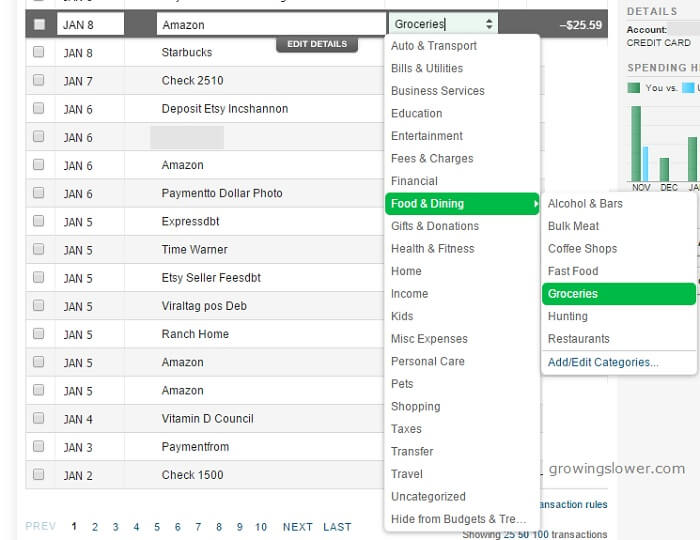

If you use Mint to start analyzing your spending, you will need to go through and double check that the budget categories for each transaction are correctly assigned.

This is the point where you’ll need to make some decisions about which categories to use for your budget. You can see from the image above that Mint has many different categories available, plus you can create your own custom categories.

In my experience, you want to have enough categories that it gives you a clear picture of your finances but not so many that it gets cumbersome to manage. I started out with 10 categories and didn’t find that to be enough to really see where our money was going. I now have about 3 dozen.

If there’s a particular category where you have struggled in the past, I’ve found that the more you break it down, the easier it is to see where the overspending is happening.

This was the case for our grocery budget. It really helped when I started breaking out food separate from household supplies like toilet paper and shampoo.

Here’s a list of the budget categories I use right now:

Income

Auto & Transport:

- Gas & Fuel

- License/Registration

- Parking

- Service & Parts

Bills & Utilities:

- Garbage/Recycling

- Internet

- Mobile Phone

- Utilities

Entertainment:

- Amusement

- Pocket Money (hers)

- Pocket Money (his)

Financial:

- Life Insurance

Food & Dining:

- Bulk Meat

- Groceries

- Hunting

- Restaurants

Gifts & Donations

- Charity

- Christmas Gifts

- Gifts

Health & Fitness

- Dentist

- Doctor

- Eyecare

- Gym

- Pharmacy

Home

- Amazon Prime

- Costco

- Home Insurance

- Home Supplies

- Lawn & Garden

- Mortgage & Rent

Kids

- Baby Supplies (This is actually all the kids’ clothes, shoes, supplies, etc.)

- Babysitter & Daycare

Personal Care

- Hair

Pets

- Pet Food & Supplies

- Pet Care

Shopping

- Clothing

Your categories could be very different from mine, but at least this will help get your wheels turning. Don’t worry too much about getting it perfect. It’s very easy to change as you continue to refine your budget.

That’s it! You don’t have to worry about making any big changes to your spending just yet.

I’m sure it’s inevitable to start thinking about how much you should be spending and where you could start saving. I’ll be sharing more about all that in the next post!

Your Pre-Budget Pep Talk

I tried and failed at budgeting for years before I finally found the few simple shifts that made it stick! If I hadn’t tried just one more time then I might never have known the feeling of financial freedom or being debt free!

You might have tried to make a budget before. You might have even tried to manage your budget with Mint and since let it slide. That’s ok! Don’t be afraid to try again.