The ‘Stay at Home Mom Calculator‘ helps you assess how you can afford to be a stay at home mom. Unlike most calculators that ask ‘Can I afford to be a stay at home mom?’, this one doesn’t give you a yes or no answer but helps you discover the steps you would need to take to make it work for your family.

The Stay at Home Mom Calculator

Inside I’ll show you:

- How this calculator is different (and more helpful) from others you might have seen

- The steps to to use the Stay at Home Mom Calculator, step by step

- How to use the results to create a plan for how you can make staying at home work for your family

The calculator that helps you see how you can afford to stay at home

There are many other calculators out there that help you answer the question ‘Can I afford to stay at home?’ The only problem is, that it’s a yes or no question.

And the result they give you is whether you can afford it or not (which in most cases, is not). Or they simply show you how much you stand to lose, financially speaking, by staying at home.

When all you want to do is be at home with your babies, those aren’t very satisfying results. You care about being there for your children, and you want to know if this will work for your budget.

Instead, the Affording Motherhood SAHM Calculator helps you calculate how much you’ll save by staying home and how much you need to make up in order to make it work, so you can make a solid plan for how you can be at home with your kids as soon as possible.

How to use the Stay at Home Mom Calculator

1. First, download the calculator

Click here to have your copy of the calculator sent to you by email. Once you click the link in your email, it will open as a Google spreadsheet.

Be sure to click File, then Make a Copy to create your own copy.

Important: As you edit the spreadsheet, only change the cells with the aqua background. The others will be automatically calculated for you.

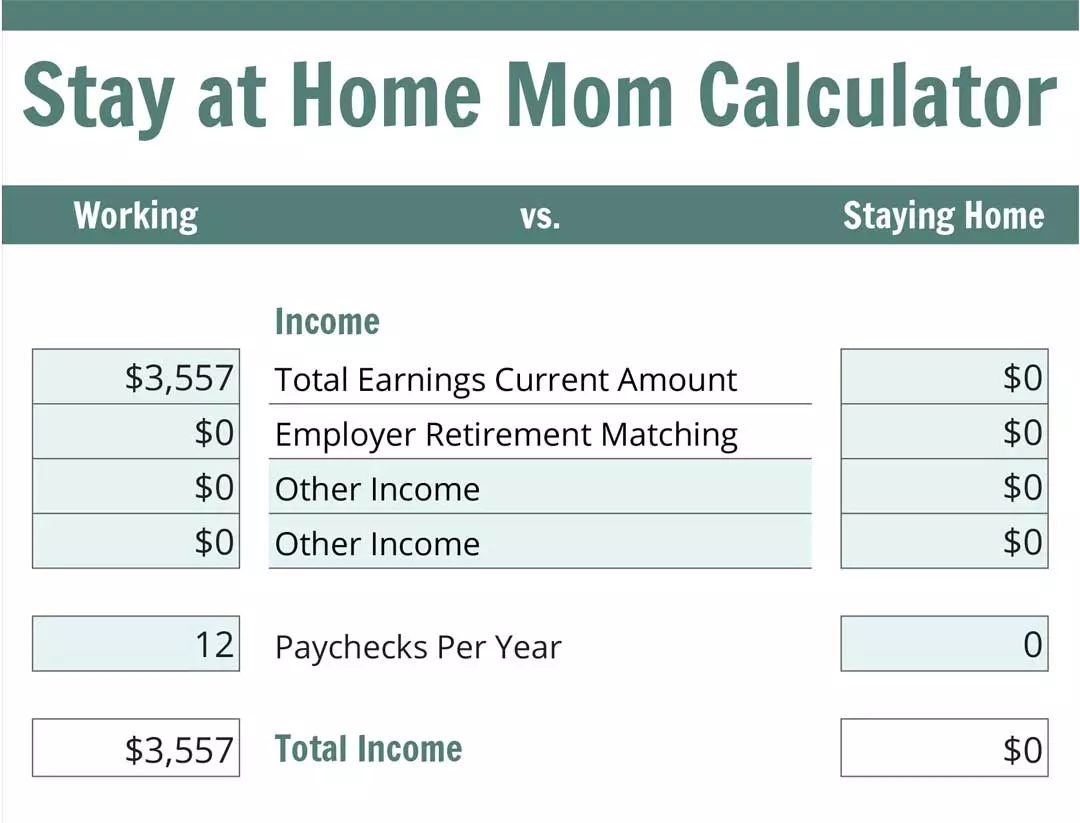

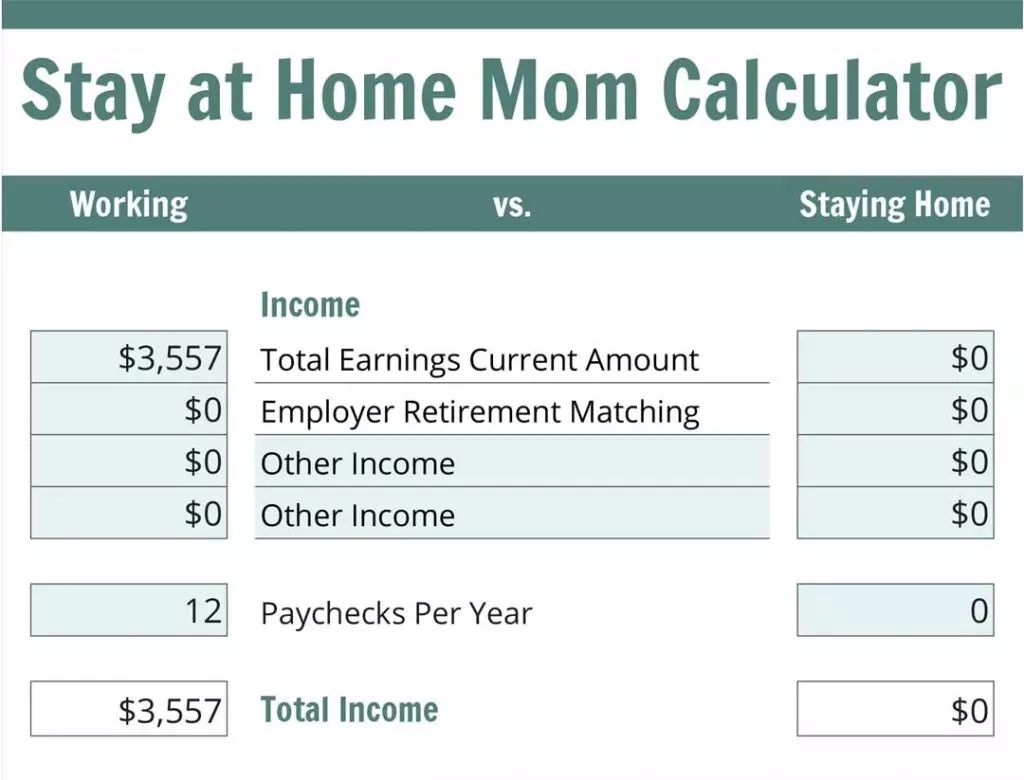

2. Now, enter your monthly income and expenses into the calculator

On the left side, you’ll list the income and expenses as they are now while you’re working at your job.

The fields are already populated with amounts based on the national averages, so you can leave any of these you’re not sure about. However, for the most accurate results, grab your most recent pay stub.

Then, enter the numbers under the Working column for the following:

- Total Earnings Current Amount

- Employer Retirement Matching

- Any other income or benefits you receive now

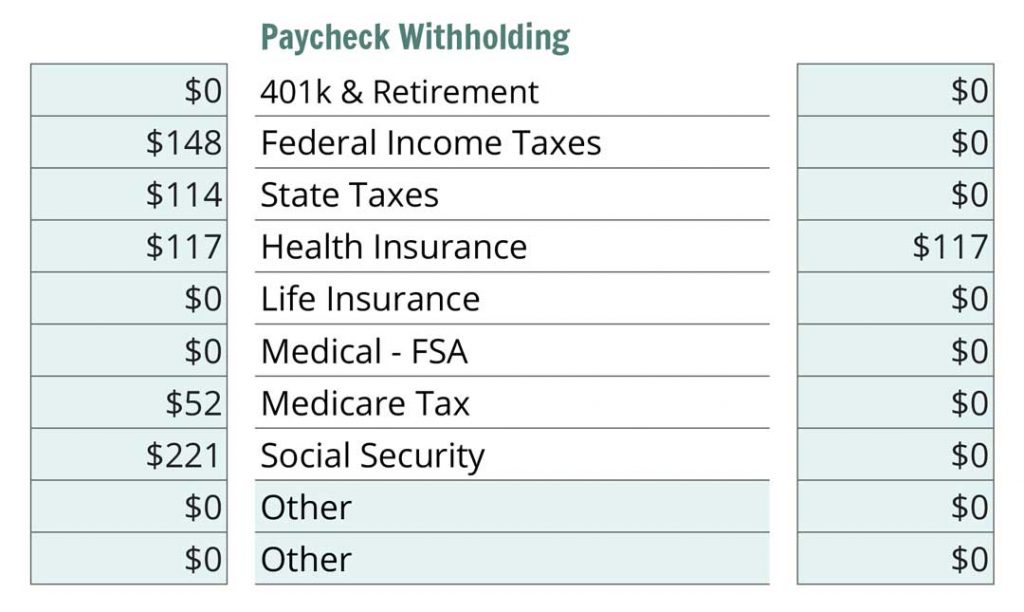

Enter your withholding listed on your paystub including:

- 401K & Retirement Contributions

- Federal Income Taxes

- State Taxes

- Health Insurance

- Life Insurance

- Medical FSA/HSA

- Medicare Tax

- Social Security

- Any other funds withheld from your paycheck

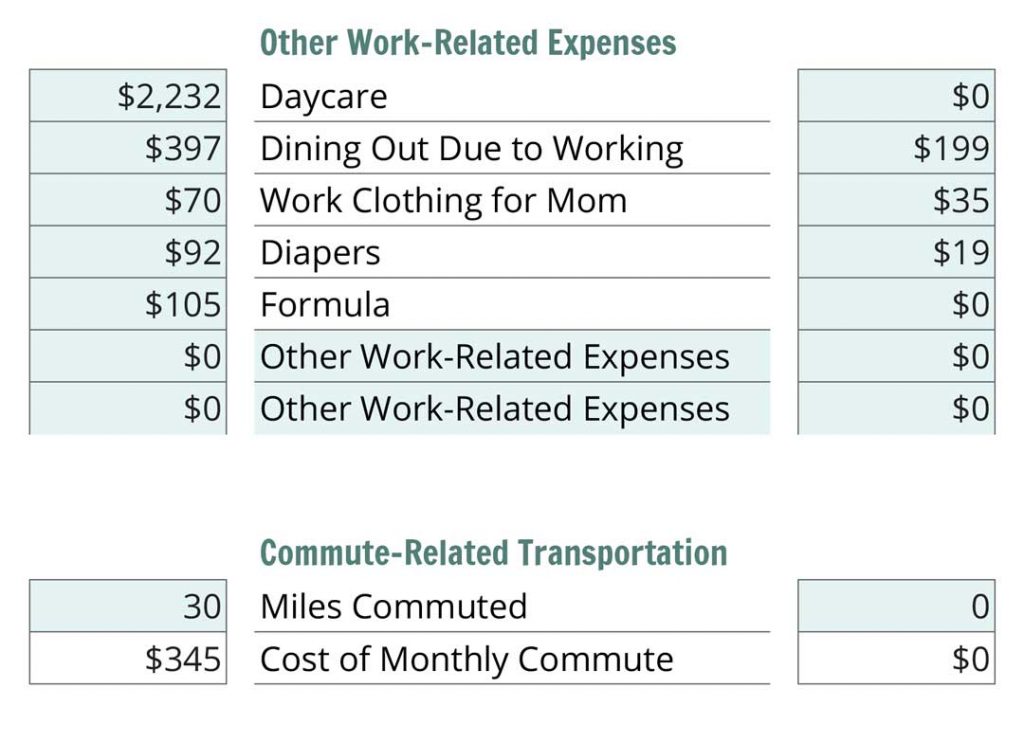

Next consider other work-related expenses, including:

- Daycare

- Dining Out

- Work Clothes

- Diapers

- Formula

- Any other work-related expenses

I’ve just listed a few, but you should include any spending that results from you going to work. It might be parking fees or dry cleaning costs — even the impulse purchases you make because you’re dead tired from your nine to five and not in the best frame of mind. See the link below for a thorough discussion of this topic.

Next Step Resource: How Becoming a Stay at Home Mom Saves Money

There is a special section in the spreadsheet to help you calculate commute-related transportation expenses. Simply enter the total number of miles you commute daily, and the cost will be calculated for you.

Remember, your transportation cost represents way more than just gas. This number also takes into account a portion of the purchase cost, insurance, and maintenance for your commute.

Finally, enter any additional costs you know you could cut once you’re home with a little extra time and energy. This could be anything from shopping for cheaper car insurance to baking your own bread.

Next Step Resource: 77+ Ways to Save Money as a Stay at Home Mom

3. Now it’s time to enter your monthly income and expenses if you were to stay at home

Go back through the list above, entering the amounts in the Staying Home column on the right as they will be once you’re staying home. Many expenses will drop to zero; others will be significantly reduced.

Again, I’ve included some averages to get you started. Update these with your actual numbers for greater accuracy.

What do the results mean?

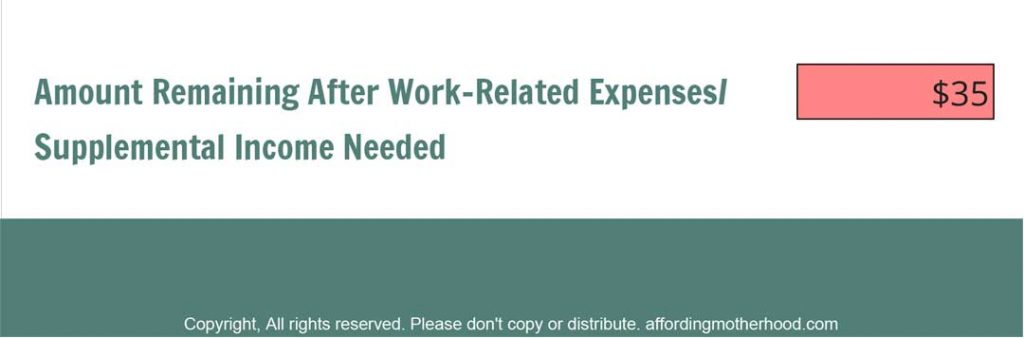

After including all of your income and expenses, the results will be calculated for you. These represent the Amount Remaining After Work-Related Expenses are subtracted. Put another way, this number is the amount of additional income you or your husband would need to bring in to allow you to stay at home without significantly changing your current financial situation.

If the number is negative and the cell turns green, this means you would come out ahead by leaving your job. In other words, you’d actually end up with extra funds at the end of the day by not working.

On the other hand, if the number is positive and the cell turns red, you need to find a way to boost your family’s income. For many moms, this means working from home part-time to make up the difference.

Next Step Resource: 25+ Ways Moms Make Money from Home

What if I need a LOT of income to make up the difference?

Maybe you make a great income, so losing it seems even scarier. Or your company has a long list of benefits that are tough to replace, including health insurance.

Depending on your situation, it may take some time to prepare to become a stay at home mom. You might need to build savings, pay down debt to save on monthly payments, or make some significant lifestyle changes. You might need to start the search for a solid work from home position.

It might seem as if staying at home will never happen for you.

But take heart, while it might not happen tomorrow, but don’t give up. I hear from moms all the time who even have teenagers, and they still want to be at home for them. Your babies will always need you whether they’re six months or sixteen years, so don’t give up even if you have to do daycare for a time.

Keep working toward your dream.

In the meantime, you can look for ways to add greater flexibility to your schedule, whether at your current job or a new one. Could you work three or four days a week instead of five? Or leave a couple of hours early to be able to pick up your kiddos and have some fun together before jumping into homework and dinner?

Whatever you do, don’t make the mistake of looking at staying home as a yes or no question. There’s a whole spectrum of scenarios that could give you more quality time with your kiddos.

What are your next steps?

Using the calculator, you have already taken the approach of becoming curious about how you could become a stay at home mom. (This isn’t a yes or no question!)

By now, I hope you have filled in the numbers to do your own analysis of your income and expenses as a stay at home mom versus as a working mom. You may have discovered you can afford to quit your job sooner than later. Now it’s time to talk this over with your spouse and decide on a timeline.

Or the results might show that you need some supplemental income to come out ahead as a stay at home mom. Don’t be concerned if this is you. For many stay at home moms, that is the case.

If that’s you, take one step today toward filling in any gaps in your income. Explore different work from home opportunities and consider which might be best for you.

Whichever the case, I hope you’ll be enjoying more time with your little ones in the very near future.